Federal income tax rate 2023 payroll

10 tax rate up to 9875 for singles up to 19750 for joint filers 12 tax rate up to 40125. What is a local income tax.

2022 Federal State Payroll Tax Rates For Employers

Nonresidents who work in Pittsburgh pay a local income tax of 100 which is 200 lower than the local income tax paid by residents.

. If your federal income tax return is examined and changed. Oklahoma reduced its corporate income tax rate from 6 to 4 percent tying Missouri for the second-lowest rate in the nation. And depending on how long you own the stock that income could be taxed at capital gain rates ranging from 0 to 238 for sales in 2021typically a lot lower than your regular income tax rate.

Eight states impose no state income tax and a ninth New. A local income tax is a special tax on earned income collected by local governments like counties cities and school districts. Your effective tax rate will be much lower than the rate from your tax bracket which claims against only your top-end earnings.

In addition to federal income tax collected by the United States most individual US. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. The daily flat rate that can be.

A corporate income tax CIT is levied by federal and state governments. The dates for 2022 estimated tax payments. States collect a state income tax.

While the federal income tax and the Colorado income tax are progressive income taxes with multiple tax brackets all local income taxes are. On your 2023 income tax return you could then deduct the balance of 200 for the part of the prepaid lease that applies to 2023. And access to up to the prior seven years of tax returns we have on file for you.

California collects a state income tax at a maximum marginal tax rate of spread across tax brackets. This represents the part of the expense that applies to 2021 and 2022. Self-employed people are responsible for paying the same federal income taxes.

Your bracket depends on your taxable income and filing status. Californias maximum marginal income tax rate is the 1st highest in the United States ranking directly. Actual results will vary based on your tax situation.

IL-1040-V Payment Voucher for Individual Income Tax IL-1040-X-V Payment Voucher for Amended Individual. The 2020 federal income tax brackets on ordinary income. Your income tax must be paid throughout the year through tax withholding or quarterly payments and reconciled yearly.

10 12 22 24 32 35 and 37. A temporary and retroactive surcharge is in effect from 2020 to 2023 bringing the rate to 115 for businesses with income over 1 million. All UI taxes for 2022 have been paid in full.

Detailed Arkansas state income tax rates and brackets are available on this page. Tax Expenditures Credits and Deductions. There are seven federal income tax rates in 2022.

The Arkansas income tax has four tax brackets with a maximum marginal income tax of 660 as of 2022. See the 2021 Federal Income Tax and Benefit Guide Line 32300 Your tuition education and textbook. With rates that tend to be lower than.

2022 Income Tax Brackets Taxes Due April 2023 Or October 2023 With An Extension For the 2022 tax year there are also seven federal tax brackets. There are seven federal tax brackets for the 2021 tax year. Form 307 North Dakota Transmittal of Wage and Tax Statement needs to be submitted by anyone who has an open withholding account with the Office of State Tax Commissioner and does not file electronically even if you did not have employees for the filing period.

Forty-two states and many localities in the United States impose an income tax on individuals. Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020. Take the total amount of tax you paid and divide that number by your taxable income.

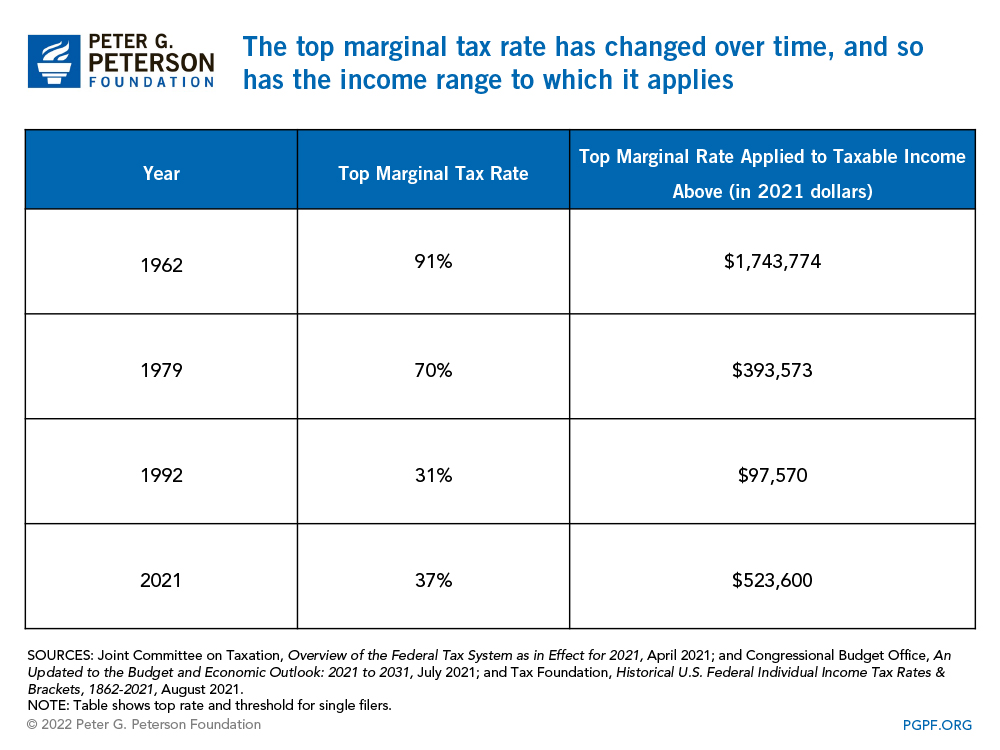

The top marginal income tax rate of 37 percent will hit taxpayers with taxable. Since then countries have recognized the impact that high corporate tax rates have on business investment decisions so that in 2021 the average is now 2354 percent and 2544 when weighted by GDP for 180 separate tax. Like the Federal Income Tax Californias income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

IL-1040-ES 2022 Estimated Income Tax Payments for Individuals Use this form for payments that are due on April 18 2022 June 15 2022 September 15 2022 and January 17 2023. Residents of Pittsburgh pay a flat city income tax of 300 on earned income in addition to the Pennsylvania income tax and the Federal income tax. Some local governments also impose an income tax often based on state income tax calculations.

This applies whether you are a resident COMAR 03040202 or nonresident COMAR 03040203 of the State of Maryland. With ISOs your taxes depend on the dates of the transactions that is when you exercise the options to buy the stock and when you sell the stock. Pittsburgh Income Tax Information.

When its time to file a federal income tax return for your small business there are various ways you can do it depending on whether you run the business as a sole proprietorship or use a legal entity such as an LLC or corporation. 2022 Tax Brackets Due April 15 2023 Tax rate Single filers Married filing jointly. Tax Rate Schedules If your taxable income on line 19 is over 100000.

Generally you do not have to make estimated tax payments if the total of your California withholdings is 90 of your required annual payment. Form 307 North Dakota Transmittal of Wage and Tax Statement Form W-2 and any Forms 1099 that. Estimates based on deductible business expenses calculated at the self-employment tax income rate 153.

2022 Federal and State Payroll Taxes Federal Taxes Federal Unemployment FUTA Social Security Tax FICA Medicare Tax FICA Federal Income Tax FIT Employer Pays. Generally you are required to use the same filing status on your Maryland income tax return as used on your federal income tax return or the filing status that you would have used if required to file a federal income tax return. Use this form to request your one-time property tax rebate.

Fourteen states including Colorado allow local governments to collect an income tax. This discounted FUTA rate can be used if. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

The Federal Income Tax is a marginal income tax collected by the Internal Revenue Service IRS on most types of personal and business income. 10 12 22 24 32 35 and 37. In 1980 corporate tax rates around the world averaged 4011 percent and 4652 percent when weighted by GDP.

Tax Compliance and Complexity. The federal income tax consists of six marginal tax brackets ranging from a minimum of 10 to a maximum of 396. 2022 Federal Income Tax Brackets and Rates.

Income and Payroll Taxes.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Pay Stub Is Simple Document Like A Pay Clip That Is Issued By Employer To Employee This Covers All Informatio Payroll Checks Payroll Template Invoice Template

3

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

3

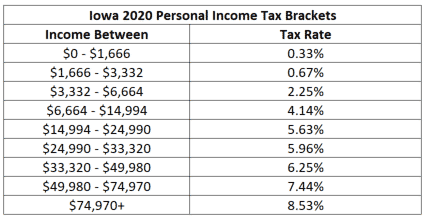

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

1

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

1

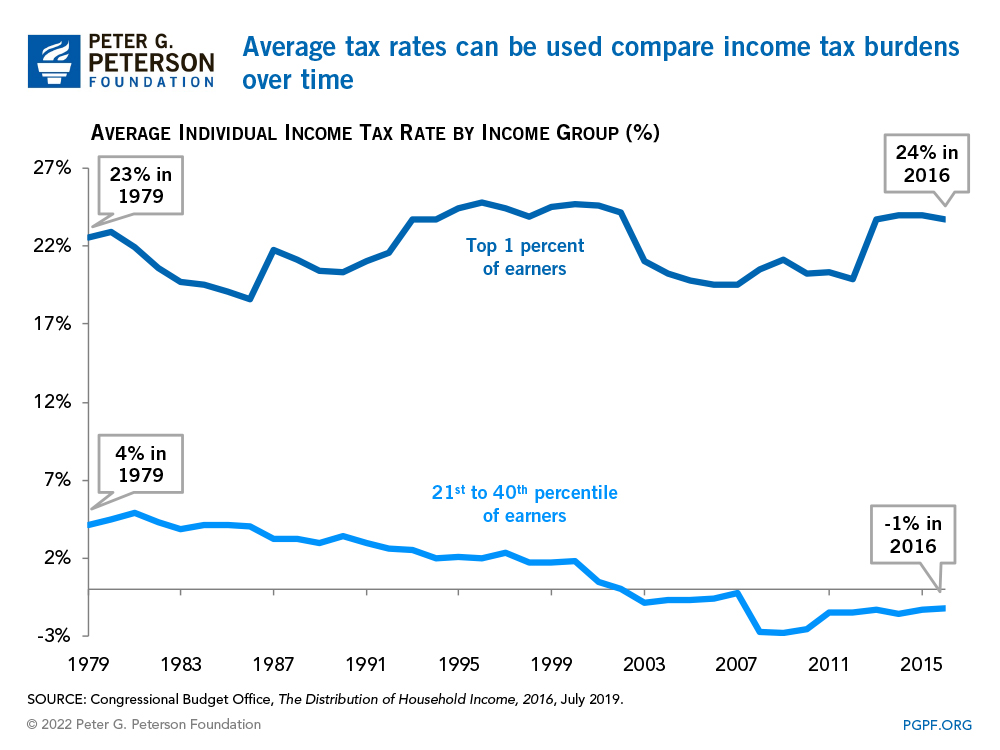

How Do Marginal Income Tax Rates Work And What If We Increased Them

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

17 Ways Your Income Taxes Will Be Different In 2023 Income Tax Payroll Taxes Income Tax Brackets

How Do Marginal Income Tax Rates Work And What If We Increased Them

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age